Retroactive Tax Credits 2024 Election Results – A $78 billion package to revive an expansion of the child tax credit and expired business breaks has drawn bipartisan support in the House and Senate. . Supporters of the bipartisan tax bill needed a statement vote out of the House Ways and Means Committee on Friday to help their cause — and they sure got one. .

Retroactive Tax Credits 2024 Election Results

Source : twitter.com

ICYMI | Current Developments in California, Florida, Indiana, and

Source : www.cpajournal.com

Who gets a break? Clashing ideas on tax relief are teed up for the

Source : www.timesfreepress.com

Who gets a break? Clashing ideas on tax relief are teed up for the

Source : apnews.com

2024 State Business Tax Climate Index | Tax Foundation

Source : taxfoundation.org

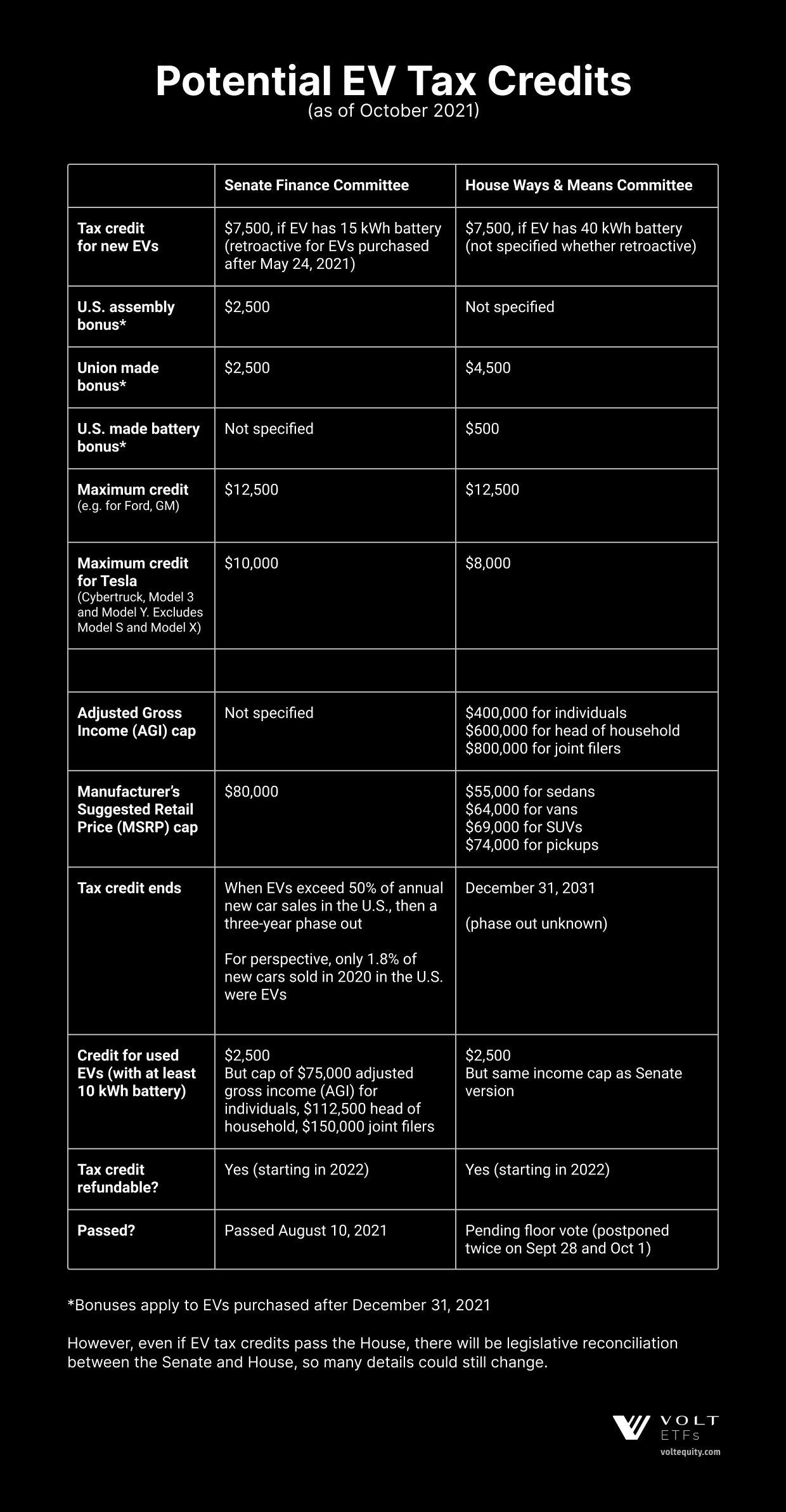

The Tesla EV Tax Credit

Source : www.voltequity.com

2024 State Business Tax Climate Index | Tax Foundation

Source : taxfoundation.org

The Tax Relief for American Families and Workers Act of 2024

Source : www.wolterskluwer.com

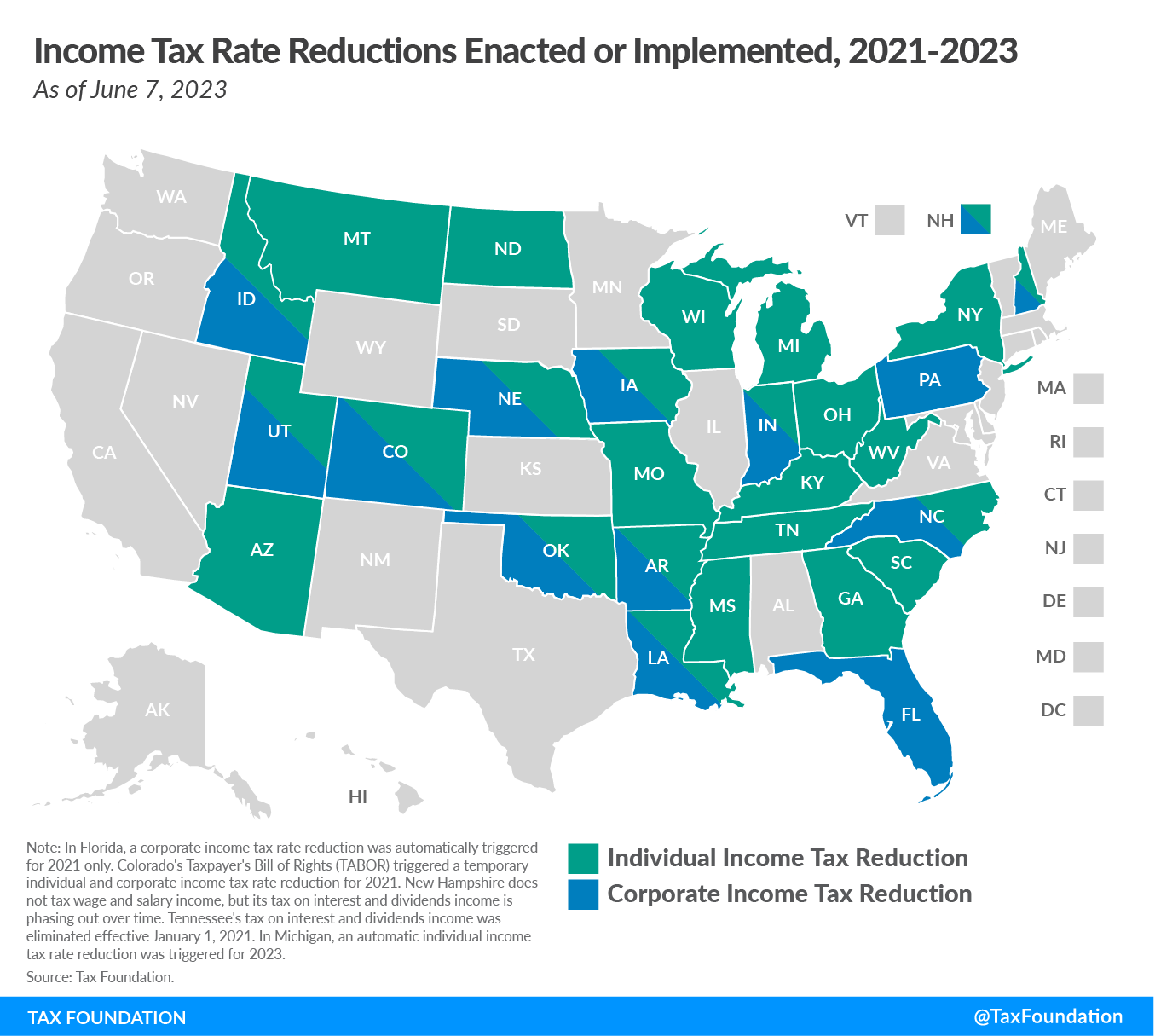

State Tax Reform and Relief Trend Continues in 2023

Source : taxfoundation.org

Bipartisan Tax Framework: Low Income, Wealthy Households Benefit

Source : www.taxpolicycenter.org

Retroactive Tax Credits 2024 Election Results Joe Kristan on X: “Iowa extends PTET deadline for 2022 retroactive : The 2024 primary schedule is listed below with the date of each state’s primary and caucus for Democrats and Republicans in the 2024 presidential primary. . A proposed bill increases the child tax credit, but fails the poorest families. Yet corporations would see a windfall. .